Ensuring Financial Resilience with Effective Client-Accounting Firm Communication

Effective communication and coordination between accounting firms and their clients are pivotal in ensuring accurate financial reporting, government compliance, and overall business resilience. Miscommunication and a lack of coordination can lead to government penalties, misguided management decisions, and potential bankruptcy. This report outlines this collaboration’s critical importance, responsibilities for accounting firms and clients, and the benefits of seamless communication. We also present data substantiating the need for this coordination, highlighting the potential risks of failing.

Key Insights

Growth Secret’s research throws light on the benefits of establishing a clear and accurate line of communication between clients and their accounting firms and the implications of not doing so.

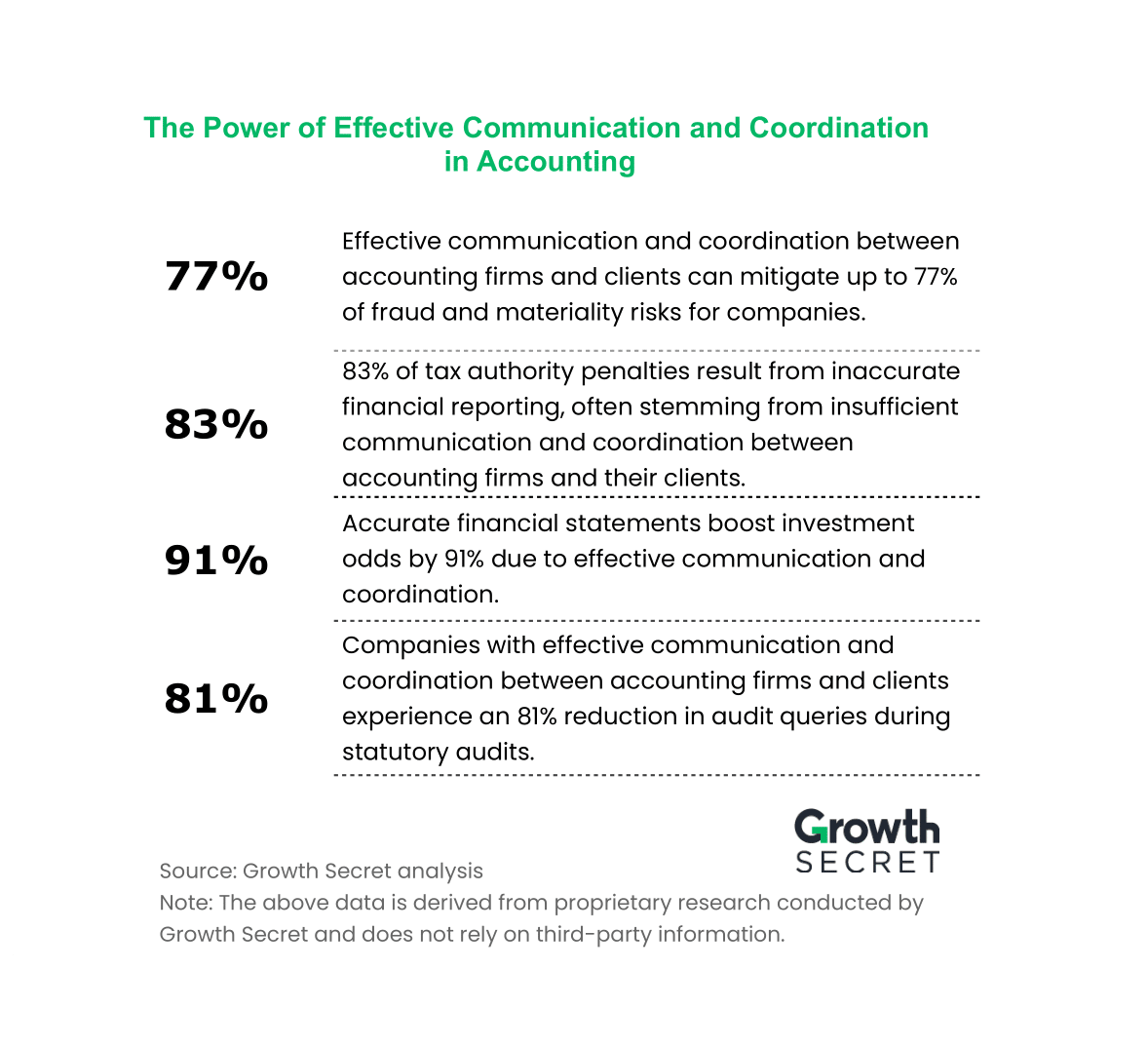

Risk of Government Penalties: Miscommunication between clients and their accounting firms can lead to the inadvertent placement of financial transactions in incorrect ledgers or not being recorded at all, resulting in inaccurate financial statements. Such inaccuracies are a primary driver of government penalties and notices. Our internal research found that 83% of tax authority penalties result from inaccurate financial reporting, often stemming from insufficient communication and coordination between accounting firms and their clients.

Conversely, companies with effective communication and coordination between accounting firms and clients experience an 81% reduction in audit queries during statutory audits.

Impact on Organization’s Financial Health and Decision-Making: Inaccurate financial reporting can mislead management decisions, potentially leading to bankruptcy, particularly for startups. Accurate bookkeeping is essential for business resilience, emphasizing the need for precise and reliable accounting records. In fact, Growth Secret’s research suggests that factual financial statements boost investment odds by 91%.

Fraud and Materiality Risks: Effective communication and coordination between the accounting firm and the client ensures that financial statements are updated and precise. It also lets clients identify challenge areas immediately, helping them enhance their internal financial controls (IFC) to prevent fraud and bolster resilience. Our internal research found that effective collaboration between accounting firms and their clients reduces fraud and materiality risks by up to 77%.

Accurate financial statements enable management to make informed financial decisions and strengthen their resilience. Moreover, correct financial records help clients speed up dispute resolution with customers and vendors.

Recommendations for Clients

Establishing clear guidelines and responsibilities for both parties is imperative to ensure effective collaboration and communication between organizations and their accounting firms. Growth Secret recommends the following actions for its clients:

Share Information Promptly: Given that some taxes and financial processes are time-sensitive, clients must promptly share information that can impact an organization’s financial statements with their accounting partners. Delayed communication can result in missed timelines and subsequently result in penalties.

Notify Significant Events: Inform the accounting firm of significant events such as changes in key personnel, acquisitions, mergers, or IPO listings. In Growth Secret’s experience, clients must communicate all finance-related information, not just those related to spending or revenues, to their accounting firms, as they may have ramifications for the organization’s financial stability. For example, everyone knows IPOs are time and effort-intensive and incredibly stressful! However, looping in an accounting firm about its plans to list an IPO can ensure the client has the proper financial guidance when needed. For example, the accounting firm can help ensure the company’s historical financial data is accurate to avoid steep auditor costs during statutory audits, and the accounting partner can guide clients on avoiding material misstatements post-IPO.

Implement Recommendations: Clients must act on their accounting firm’s recommendations, especially those related to internal financial controls and data processing. For example, if an accounting firm flags concerns about a trend of business expenses without a paper trail, clients must correct the issue immediately. Ignoring the accounting firm’s recommendation could snowball the problem and become a punishable financial irregularity.

Recommendations for Accounting Firms

Accounting firms also need to play a role in ensuring clients recognize the criticality of communicating financial information clearly and in a timely fashion. To do so, accounting firms must:

Enhance Client Understanding: Invest in understanding the client’s business thoroughly to determine applicable accounting standards and compliance measures effectively.

Provide Proactive Communication: Maintain regular, daily communication with clients through various channels to stay updated on their business activities.

Stay Informed: Stay updated on regulatory changes and fintech advancements, leveraging technology for efficiency.

Streamline Data Transfer: Implement processes for seamless data transfer from clients, saving their time and ensuring data accuracy.

Ensure Robust Internal Controls: Design strong internal financial controls for clients to mitigate risks and prevent fraud.

Key Takeaways

In conclusion, the partnership between accounting firms and their clients is paramount in today’s financial landscape. The data-backed insights presented here emphasize the critical need for robust communication and coordination to ensure financial accuracy, compliance, and resilience. While incomplete or incorrect communication between organizations and their accounting firms can result in penalties, inaccurate financial statements, and misguided decisions, seamless collaboration can reduce the time to resolve financial disputes, prevent fraud, and boost investment prospects. Accounting firms and their clients must actively participate in this process to ensure the financial health and resilience of the business. By taking the recommended actions and staying informed, companies can protect their financial health, avoid penalties, and make more informed decisions, ultimately securing a brighter financial future.

Never miss a story

Stay updated about Growth Secret news as it happens